Confused between Apple Pay and PayPal? Check our guide that explains if and is Apple Pay Better than PayPal.

Apple Pay is one of the most popular payment service systems right now. All iPhones come with it and it is an easy way to make and receive payments on. With the increase in popularity of Apple Pay, services like PayPal have seen a decline.

So, is Apple Pay better than PayPal? It is not easy to give a definite answer. Both payment services have their advantages and disadvantages and we will explore them in this article.

Spoiler Alert: Apple Pay is better than PayPal for day to day commercial use for normal folk. However, PayPal is better for professional use which needs large amounts of money to transact. Read our guide for a detailed explanation of Is Apple Pay Better than PayPal.

Related: How to Use Apple Pay at ATMs in 2023

Is Apple Pay Better than PayPal

Table of Contents

What is Apple Pay

The newest player on the block, Apple Pay, is making a lot of news. The iPhone 6’s Apple Pay feature enables customers to store their credit card information and use their phones to make purchases at any of the thousands of participating retailers.

To make taking use of the benefits offered by your loyalty cards easier, you can also put the data for such cards onto the app.

Apple has emphasized the service’s simplicity of use and security advantages over the other solutions mentioned above.

Your credit card number is never seen by anyone during a transaction, Apple doesn’t keep track of your transactions, and Touch ID, Apple’s fingerprint authentication sensor, is required to make payments. This is perhaps the greatest option for those worried about theft and privacy.

How to Set up Apple Pay

To use Apple Pay, you need:

- A compatible device running the most recent versions of iOS, iPadOS, watchOS, or macOS is required in order to use Apple Pay.

- A supported card issued by a card issuer.

- Your Apple device is logged in with an Apple ID.

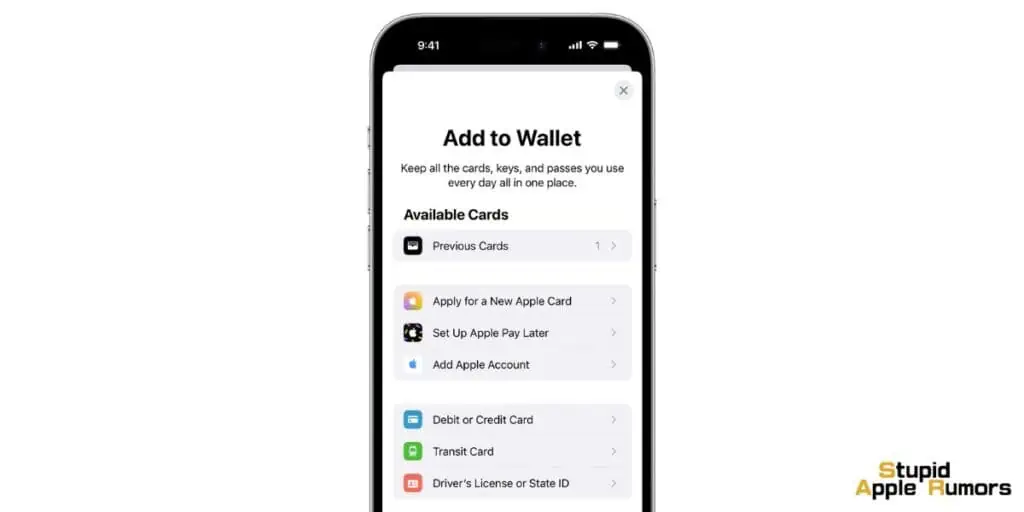

How to add a debit or credit card to your iPhone

Step 1 Open the Wallet app, and tap on the Add button.

- Tap Debit or Credit Card to add a new card.

- Tap Previous Cards to add a card that you used previously.

Step 2 Tap on Continue.

Step 3 Follow the instruction on the screen to add a new card.

Step 4 Check your information by calling your bank or credit card company. Before allowing you to use your card with Apple Pay, they can require you to fill out a form or download an app.

Step 5 You can also add the card to your Apple Watch if you have one that is connected.

By selecting Edit > Remove button > Delete, a card can be deleted from the Previous Cards screen. The card will then be deleted from all of your devices after you tap Delete Card to confirm.

Check if Apple Pay is available in your country here.

What is PayPal

In contrast to Google and Apple, PayPal’s whole business model is centered on enabling users to send and receive money.

The advantage of having PayPal’s mobile wallet app available to users of a variety of different devices is similar to that of Google Wallet.

The app is quite easy to download and set up if you already have a PayPal account, which is something that many people do by this point.

However, utilizing it is a little trickier than using the others. It can take longer to use than just pulling out a card because you have to check in at the place you’re in before making the purchase.

People have considered their mobile payment app’s capabilities to be amazing, but the interface is difficult to use.

How to Setup PayPal

Go to the PayPal Website and follow these steps,

Step 1 Select your account type.

Step 2 Create your login details.

Step 3 Give your details.

Step 4 Link your credit or debit card.

Step 5 Verify your email address.

Step 6 Verify your mobile phone number.

Features of Apple Pay and PayPal

Features of Apple Pay

- Send & Receive Money

- Siri Send & Receive Assist

- Bank Account Transfer

- Face ID Authentication

- Touch ID Authentication

- Passcode Authentication

- Web Store Transactions

- In-App Transactions

- In-Store Payments

- Returns Processing

- Rewards Program Integration

Features of PayPal

- Accept PayPal payments

- Accept Visa, Mastercard, and American Express

- Virtual Terminal

- Accept payments in 25 currencies from 202 countries

- Payment Gateway

- Options to simplify PCI compliance

Pros and Cons of Apple Pay and PayPal

Apple Pay

Pros

- Simple to incorporate with our current systems. widely recognized and used by consumers and the market.

- It’s great that so many shops and websites accept Apple Pay. Your digital wallet may be easily expanded with cards, and it is incredibly safe.

Cons

- Sometimes faulty and inoperative at some retailers, forcing customers to use a card instead.

- It is aggravating, for example, because it doesn’t work with my current bank as opposed to my previous bank. But at least receiving by bank transfer doesn’t take too long.

PayPal

Pros

- Customer support was undoubtedly the aspect of this product that I loved the most. They did a great job of assisting me in finding a solution quickly.

- Many retailers and sellers find it simple to utilize. Additionally, I value their assistance because it has allowed me to quickly handle problems.

Cons

- The procedure for disputing charges for orders not received is not something I like. I frequently experience not receiving goods or receiving a product that is of poor quality and am unable to get a return.

- My two pet peeves with PayPal are its account limits and preference for customer disputes over vendor issues. This has encouraged a lot of fraud.

Apple Pay Later vs PayPal Pay Later

Both offer the convenience of deferred payments, but they come with distinct features and benefits.

Apple Pay Later

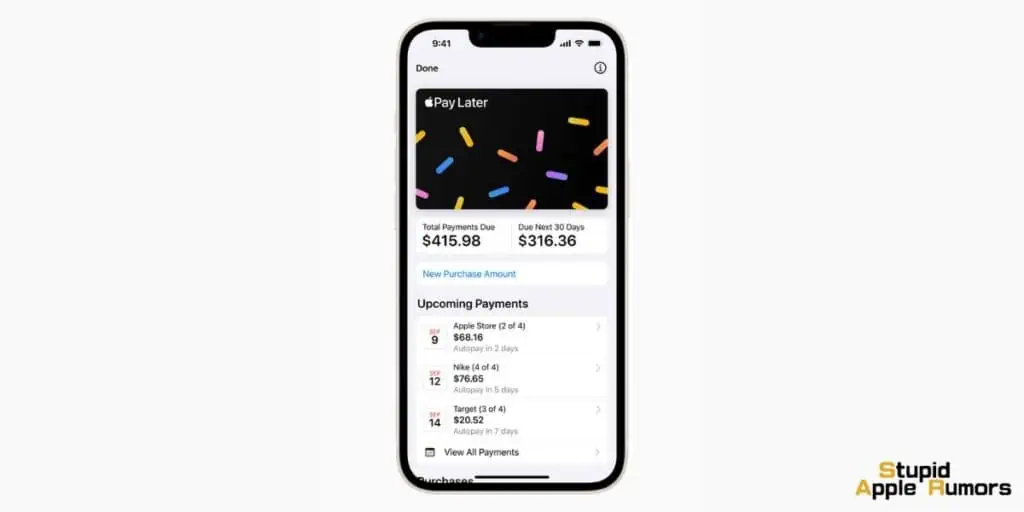

Apple Pay Later is tailored with your financial health in mind, allowing purchases to be split into four payments over six weeks, completely interest and fee-free.

You can apply for an Apple Pay Later loan within the Wallet app, with no impact on your credit. The process is transparent, ensuring you are in a good financial position before taking on the loan.

The benefit of Apple Pay Later is that it seamlessly integrates into Wallet, so you can effortlessly track, manage, and view all your loans in one convenient location.

Purchases using Apple Pay Later are authenticated using Face ID, Touch ID, or passcode. Moreover, transaction and loan history are never shared or sold to third parties, prioritizing your privacy.

Apple Financing LLC, a subsidiary of Apple Inc., oversees Apple Pay Later, promoting responsible lending practices by reporting loans to U.S. credit bureaus.

- Loan Amount: $50 to $1,000 vs $30 to $1,500

- Number of Payments: 4 vs 4 (Pay in 4) or 6, 12, 24 (Pay Monthly)

- APR: 0% vs 4.99% – 35.99%

- Repayment Method: Debit card or confirmed bank account vs Debit card, credit card, or confirmed bank account

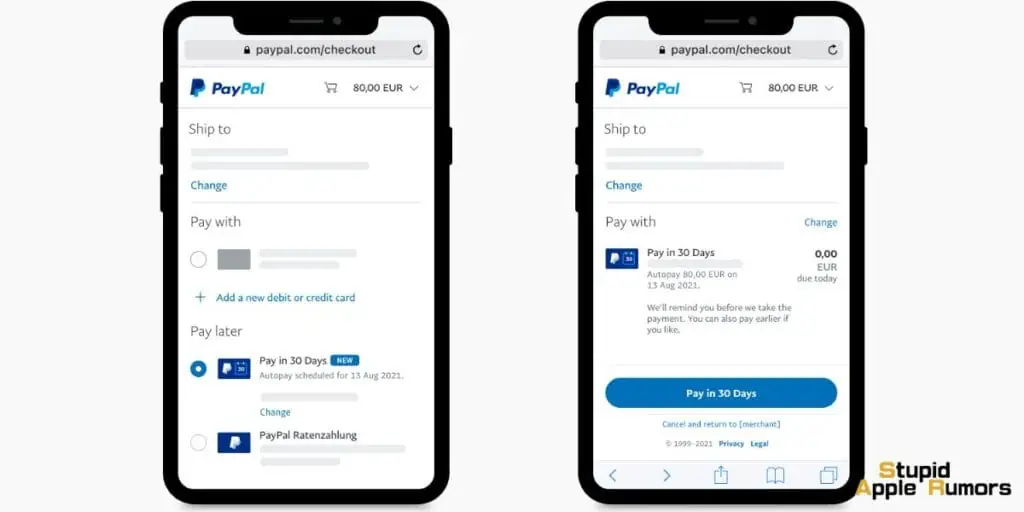

PayPal Pay Later

PayPal Pay Later as well, provides the freedom to enjoy your purchases immediately and spread payments over weeks or even months, giving you the flexibility you need.

With PayPal Pay Later, you won’t have to worry about late fees. Whether you choose the Pay in 4 option or the Pay Monthly plan, you can shop with confidence, knowing you won’t incur additional charges.

This mode of payment is widely accepted across various brands, allowing you to shop at your favorite stores while enjoying the convenience of deferred payments.

One good thing about using the Pay in 4 option is that it won’t affect your credit score, plus, the process is quick and hassle-free, ensuring you get the decision you need when you need it.

With PayPal Pay Later you get an option to choose both Purchase and Fraud Protection on eligible purchases, adding an extra layer of security to your transactions.

- Pay in 4: Split purchases between $30-$1,500 into 4 interest-free, bi-weekly payments without the stress of late fees.

- Pay Monthly: Enjoy the ease of 6, 12, or 24-month payment plans, $0 down, and no sign-up or late fees.

Is Apple Pay Better than PayPal – Conclusion

Apple Pay is better than PayPal in my opinion. It is free, simpler, and easier to use. However, if you are a business owner and do large transactions on a regular basis, then I would recommend PayPal.

Apple Pay is better for layman, while PayPal is more suited for professionals. Both have their advantages and disadvantages, so we hope you were able to come to conclusion for the question, is Apple Pay better than PayPal?

Also Read: