Want to use Apple Pay but it is not supported in your country? Learn How to use Apple Pay in an Unsupported Country in this guide.

So you reside in a nation that, regrettably, does not currently offer Apple Pay? Or if you reside in a nation where Apple Pay is accepted but your bank hasn’t yet embraced contactless Apple Pay payments? If you fit either of these two descriptions, we provide a way for you to start using Apple Pay right away, anywhere in the globe.

Apple Pay, which was first introduced in the US in 2014, is now accessible on iPhone 7, 7 Plus, 6, 6 Plus, 6s, SE, and Apple Watch, and in the US, UK, Canada, Australia, Singapore, and China. support for progressively more nations and banks.

Learn How to use Apple Pay in an Unsupported Country in this guide.

Related: Can You Use Apple Pay while on a Phone Call

How to use Apple Pay in an Unsupported Country

Table of Contents

You can utilize the procedure outlined here to start using Apple Pay right away until it becomes available in your nation or through your bank. This approach is far from ideal and has many drawbacks (more on those later), but if you want to experience the payments of the future now, this is your only opportunity.

This technique effectively makes use of a virtual debit MasterCard issued by a third party, Boon, from the UK, which you can register in your name, add to the Google Wallet app, and top up the credit using a debit or credit card you can use. Almost any bank in the world allows you to own. This is the procedure.

Step 1: You must first create an Apple ID in a UK Apple App Store. You may find instructions for doing so here: How to Create an iTunes Account in the US, UK, or Anywhere Else in the World.

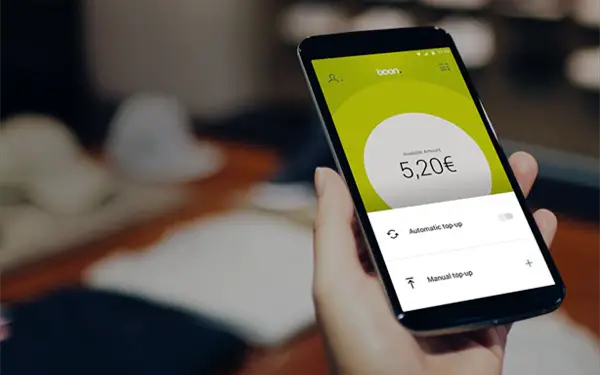

Step 2: After that, open your iPhone’s App Store and download the Boon app. The UK App Store offers it without charge.

Step 3: Open the Boon app and sign up for an account by simply following the on-screen steps. This can be done from any nation, using your genuine phone number.

Step 4: After everything has been validated, you will receive a Boon START account with £ 5 in free credit that you may use to make any purchase.

Step 5: Upgrade to a Boon BASIC or PLUS account before adding a legitimate debit or credit card to your Boon account in order to add more credit. Now that Apple Pay is not required, this debit or credit card can come from any bank or nation. It will only be used to add more credit to your Boon virtual debit card, which you can then use to make purchases using Apple Pay.

Step 6: Lastly, just add this card to your iPhone and Apple Watch’s Wallet app (if you have one). To achieve this, tap the “+” button beside Add to Apple Wallet and then wait while it processes and verifies the Boon wire transfer with Apple for Apple Pay.

You can repeat the process to add it to Apple Watch once it has been verified and enabled for iPhone. Make sure your Apple Watch is protected with a password. This is a need for security and authentication when using Apple Pay with Watch.

Advantages of Using Apple Pay for Payments

This Boon Wirecard works with any contactless payment reader that accepts MasterCard to use Apple Pay. using iPhone. Simply hold the device close to a contactless payment terminal or reader with your finger on the Touch ID for authentication, and payment should be processed immediately.

This can be done when the screen is off by double-clicking the Home button to display Wallet on the locked screen with your default card set for Apple Pay. Your iPhone will make a faint sound, vibrate slightly, and display a checkmark to indicate that the money has been received.

Similar to this, on an Apple Watch, double-clicking the side button will display your default card on the screen; all you need to do to complete the transaction is place the card close to a contactless scanner.

When using your Apple Watch to make a payment, you don’t need to utilize Touch ID or a password because it has already been authorized when you use and unlock it.

Disadvantages of using Boon for Apple Pay

There are several restrictions when using Boon for Apple Pay, as I have indicated. For one, each top-up to your debit or credit card will run you about £1. Second, because this Boon bank card is issued in the UK, each Apple Pay transaction that takes place outside of the country will incur a modest fee.

Finally, even if you have upgraded to a Boon BASIC or PLUS account, there is a credit top-up cap.

Even while these restrictions could put off some people, it’s still worthwhile to give it a shot, especially if you’ve never used Apple Pay and want to experience what it’s like to make a purchase in a physical store.

If nothing else, you can use the £ 5 free credit you first receive by joining up with Boon to pay for something (coffee, soda, or fries at McDonald’s).

I personally have used Apple Pay at several merchant locations including in Dubai while using a Boon Wirecard, and it has always worked flawlessly. It was very helpful when using the London Underground and paying for buses. Just a quick swipe of my Apple Watch at the contactless readers at the station or on the bus.

Countries and regions that support Apple Pay

On the iPhone, iPad, Apple Watch, and Mac, Apple Pay provides a quick, private, and secure method of payment.

Anywhere you see these icons and logos, including in apps, websites, and Safari, Apple Pay is accepted. You can add your credit, debit, or prepaid cards from participating banks and card issuers in these countries and regions:

Africa

- South Africa

Check out the participating banks and card issuers in Africa.

Asia-Pacific

- Australia

- China mainland*

- Hong Kong

- Japan

- Macao

- Malaysia

- New Zealand

- Singapore

- Taiwan

Check out the participating banks and card issuers in Asia-Pacific.

*In the Chinese mainland, Apple Pay is only available in Safari on supported iPhone and iPad models running iOS 11.2 or later.

Europe

- Armenia

- Austria

- Azerbaijan

- Belarus

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Faroe Islands

- Finland

- France

- Georgia

- Germany

- Greece

- Greenland

- Guernsey

- Hungary

- Iceland

- Ireland

- Isle of Man

- Italy

- Kazakhstan

- Jersey

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Moldova

- Monaco

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- San Marino

- Serbia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Ukraine

- United Kingdom

- Vatican City

Check out the participating banks in Europe.

Latin America and the Caribbean

- Argentina

- Colombia

- Costa Rica

- Brazil

- Mexico

- Peru

Check out the participating banks in Latin America and the Caribbean.

Middle East

- Bahrain

- Israel

- Jordan

- Kuwait

- Palestine

- Qatar

- Saudi Arabia

- United Arab Emirates

Check out the participating banks in the Middle East.

North America

- Canada

- The United States

Check out the participating banks in North America.

Only in the United States is it possible to send and receive money with Apple Pay and the Apple Cash card. The FDIC-member Green Dot Bank offers several services.

Only Americans are eligible to use Apple Cards. The Salt Lake City Branch of Goldman Sachs Bank USA is the one that issues Apple Cards.

Businesses will be allowed to use Business Chat on a rolling basis in some nations and regions.

How to use Apple Pay in an Unsupported Country – Conclusion

So, there you have it, all the instructions on How to use Apple Pay in an Unsupported Country. While it is not simple as using Apple Pay in a supported country, there are still some upsides to it. If you really want to use Apple Pay, then you can try this method.

Also Read: