Want to use Apple Pay at ATMs? Check out how to use Apple Pay at ATMs in this guide.

Apple Pay has been one of my favorite services from Apple. It is a quick, easy and convenient way to make payments at restaurants, shops, stores, and more. But did you know that you can use it to withdraw money from ATMs?

If you didn’t know before, then yes, you can withdraw money from ATMs using Apple Pay. Just like making payments, it is simple, fast, and convenient. Check out how to use Apple Pay at ATMs in this article.

Related: Why has my Apple Pay Declined?

How to Use Apple Pay at ATMs

Table of Contents

Using Apple Pay at ATMs is a straightforward process.

To begin, open the Wallet app on your iPhone and select the desired card for the transaction.

Then, hold your iPhone over the ATM’s contactless symbol and authenticate the payment using Touch ID or Face ID.

Enter your ATM PIN to complete the withdrawal.

Keep in mind that not all US banks support Apple Pay at ATMs. Some of the banks that do accept Apple Pay include Chase Bank, Bank of America, Wells Fargo, and CitiBank.

On the other hand, certain banks like Bank of Hawaii, City National Bank, Fifth Third Bank, and others do not currently accept Apple Pay at ATMs.

You can also withdraw money from Apple Pay through ATMs locally or internationally or use it for purchases and cashback rewards.

How to Use Apple Pay at ATMs with Steps

Withdrawing money at an ATM using Apple Pay is as simple as using Apple Pay at a store. Learn how to use Apple Pay at ATMs by following the below steps,

Step 1 Open the Wallet app on your iPhone.

Step 2 Choose the card you want to use to withdraw money.

Step 3 Now, place your iPhone over the contactless symbol on the ATM.

Step 4 Authenticate the payment by using Touch ID or Face ID.

Step 5 Enter your ATM PIN to withdraw money.

Which ATMs accept Apple Pay?

While you know how to use Apple Pay at ATMs, check out which banks actually allow you to do this.

Not all banks in the USA let you withdraw cash from ATMs using Apple Pay. Here are the banks that allow you to use Apple Pay at ATMs,

- America’s Chase Bank

- Bank of America

- Wells Fargo

- CitiBank

Which ATMs don’t accept Apple Pay

There are banks that offer cards free withdrawal of cash, but you will need to use their apps instead of Apple Pay.

Hope these banks also add Apple Pay support for increased convenience. But for now, these are the banks that don’t accept Apple Pay at ATMs,

- Bank of Hawaii

- City National Bank

- Fifth Third Bank

- First Farmers Bank & Trust

- HomeStreet Bank

- PlainsCapital Bank

- PNC

- Wintrust

- BB&T Bank

- BBVA

- HSBC

- Regions

What are the Advantages of Apple Pay?

There are many reasons why people prefer Apple Pay over using traditional cards. Here are the advantages of Apple Pay and why you should give it a try,

Convenient Payment

Once you have added your cards to your Apple Wallet, you can use it to easily make transactions. Since Apple Pay uses NFC, all you have to do is place your iPhone or Apple Watch near the NFC scanner in a store or ATM and use Touch ID/Face ID to authenticate the payment. With Apple Pay’s popularity increasing, it is one of the best ways to pay at a store. You don’t need to carry cash or cards, adding to the convenience.

Safe and Secure

Apple Pay is safe and secure as you need your TOuch ID, Face ID, or Passcode to authenticate any transaction. You also don’t have to carry your cards or cash which means a reduced chance of losing them. Apple Pay does not store your card information on your iPhone (it uses a special ‘Device Account Number’ to complete transactions), so your information is safe.

Offline Payments

Contrary to popular belief, Apple Pay can be used offline as well. Since Apple Pay uses NFC and your cards to make payments and so it doesn’t require the internet to complete transactions. SO stores and ATMs that support Apple Pay don’t require an internet connection to complete transactions. This makes it convenient to use when away from home.

No Additional Fees

Apple Pay is completely free for users. You don’t have to pay anything for using the service, so you might be wondering how Apple benefits from this arrangement. Apple charges 0.15% of the transaction from the business owner. So, the small amount does not affect the business owner for increased convenience for both them and the customers.

Privacy

As I mentioned before, Apple does not store your credit card data on your iPhone or on its servers, which means your valuable information is private. Apple also doesn’t track or store purchase information (apart from transaction data for future reference) so you can pay with confidence. Apple Pay is safer than using credit cards or cash.

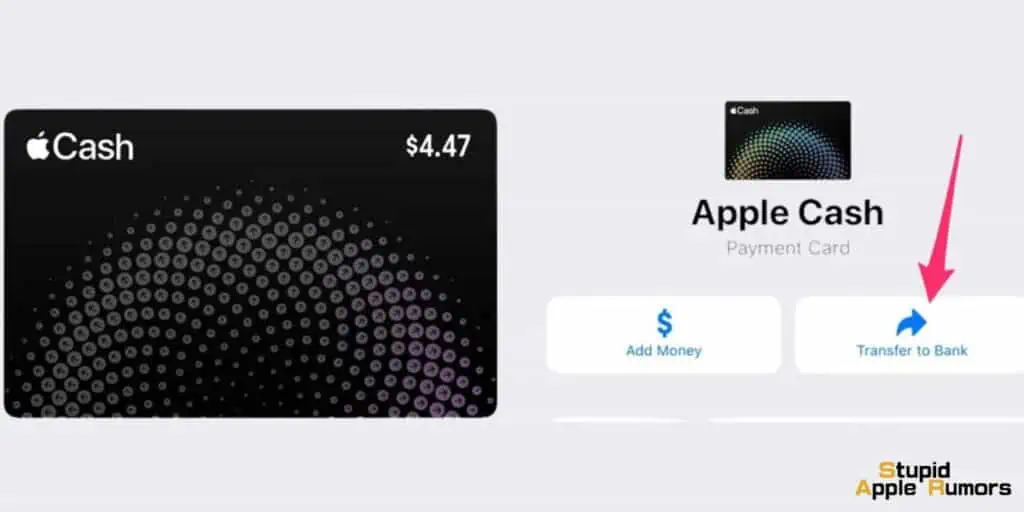

How Do I Withdraw Money from Apple Pay?

Withdrawing money using Apple Pay from your bank account is simple. You can withdraw money from an ATM if you have Apple Pay Cash available, or you can also use it for purchasing things from stores.

You might even receive a cashback when you use Apple Pay Cash for purchasing. Purchasing at convenience stores won’t reward you with cashback. You can also transfer the earned cashback to your bank too.

You can use Apple Pay Cash to buy gift cards and even add them to Apple Pay so that you can use them almost anywhere. If you receive gift cards from any purchase, then you can add that t your Apple Pay account if it’s compatible.

Overall, Apple Pay and Apple Cash have endless uses, so trying them out for yourself is something I recommend. And it is not hard either, so do give Apple Pay a try, it’s completely free too.

How to securely use Apple Pay

You now know How to Use Apple Pay at ATMs. But check out what makes it secure.

Apple Pay uses two-factor authentication and NFC (Near Field Communication) to make sure that it is safe to use. Both of these make it hard for someone to get hold of your account information and steal from you.

We all know how secure Apple devices are, so even if it gets stolen, no one will be able to steal money from your account. Yet, there are still things that you can follow to make it more secure, and they are,

Never Share your Banking Information

Don’t share your bank details with anyone that you don’t know or trust. Don’t share passwords too, these are yours and yours alone. If it gets in the wrong hands, it could hurt you a lot financially. Your details and information are yours alone.

Check your Transaction History

Make sure to check your bank account at the end of every day and keep an eye out for any suspicious transactions. If there are any, get them cleared by your bank. If there is a risk, notify your bank and take any necessary actions.

Can I use Apple Pay in International ATMs?

Yes, Apple Pay works in ATMs abroad. It works in any country that supports contactless payment technology.

However, when it comes to using Apple Pay for ATM withdrawals internationally, there’s one important factor to consider: you need to find ATMs that have contactless capabilities in the country you’re visiting and the bank whose ATM you’re using should be one of the banks that support Apple Pay.

While cardless ATMs are becoming more common globally, they are still relatively new and not yet available everywhere.

According to Six Group⁶, a European financial infrastructure company, the number of contactless ATMs worldwide increased by 26% in 2019, and the COVID-19 pandemic has likely contributed to further growth.

For instance, in Switzerland, around 20% of all ATMs had contactless withdrawal options in 2020, and this percentage is likely to have increased since then.

So, as long as you can locate cardless ATMs during your travels, using Apple Pay to withdraw cash overseas should be as easy as doing it at home.

Conclusion

That’s all folks, I have explained how to use Apple Pay at ATMs, which banks accept Apple Pay at their ATMs, and more questions related to the topic.

Using Apple Pay to withdraw cash is extremely convenient and I do it all the time. It saves time and I don’t have to carry my cards everywhere.

I would definitely recommend you to try this and see it for yourself. Once you get a hang of it there is no going back. It is a game-changer and has made life a tad bit easier for me.

FAQs

Why Was My Apple Pay transaction declined?

If your Apple Pay transaction was declined, then it can be due to two reasons, one is a low balance and the other can be that your account or card is expired or blocked. You can contact your bank if it’s the second reason.

Why isn’t my debit card recognized by Apple Pay?

Your debit card might not be recognized by Apple Pay if Apple Pay servers are down. You can check this from the System Status page on Apple’s website. When Apple Pay is down,it might not be able to recognize your digital wallet or your debit card. And in such rare instances, all you can do is wait.

Can I get cashback by using Apple Pay?

You can get cashback when you use Apple Cash. Apple Cash is available only in select stores, so it might be hard to earn cashback, but with an increase in popularity and demand, we hope to see it in many stores in the future.

To earn cashback, you have to set up Apple Cash (different from Apple Pay), and then make a payment with Apple Cash. You will earn a small percentage as cashback which you can transfer to your bank account that is linked to Apple Pay.

Note that, you won’t receive cashback for Apple Pay.

Is it possible to use my Apple Card at an ATM?

Apple Card, which is different from Apple Pay is a credit card service that you can use to purchase at stores. The only drawback to the card is that you won’t be able to use it at ATMs to withdraw cash, you can only use it to make purchases at stores.

Is There a Downside to Using Cardless Cash ATMs?

The only major downside to cardless cash ATMs is that service is still not widely available. You can only use Apple Pay to withdraw cash at only a handful of bank ATMs. Similarly, you can also use banking apps to withdraw cash without using cards at an ATM, but it will be limited to the bank and its app.

Also Read:

- Complete List of Stores that Accept Apple Pay

- Google Pay to Apple Pay – Can I do that?

- Which Fast Food and Stores Accept Apple Pay

A hardcore Apple fan with a collection of

All series of Airpods

All series of fake airpods from China

All series of Apple watches

One Macbook Pro

One iPhone 13 Pro, one iPhone XR, one iPhone 7