Want to know how Apple makes money using Apple Pay? Check out our guide on How does Apple make money from Apple Pay to know more.

Apple Pay is an extremely popular online payment system. Most iPhone users use Apple Pay as their primary method to send and receive money on their iPhones. This is because Apple Pay is easy and convenient to use.

This might make you question, why does Apple have Apple Pay and how do they make money off it. After all, Apple is a business and everything they do is to make money. So, How does Apple make money from Apple Pay even though it is free to use?

Apple Pay generates revenue through two primary avenues:

- Transaction Fees: Apple charges a percentage fee to the card issuer whenever a customer uses Apple Pay for a purchase. This fee is typically set at 0.15% of the transaction amount.

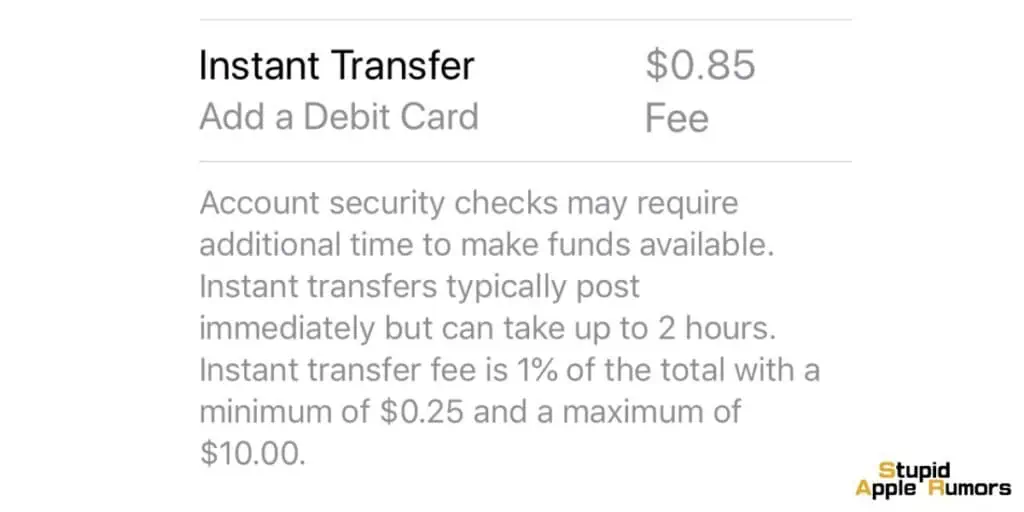

- Instant Transfer Fees: Apple also applies a fee for instant transfers from Apple Cash to a bank account or debit card. This fee amounts to 1%, with a minimum fee of $0.25 and a maximum fee of $10.

Importantly, Apple Pay users do not bear any costs for utilizing the service. Instead, these transaction and instant transfer fees are covered by the banks and merchants participating in the transaction.

Related: Will Apple Pay Work If I Cancel my Card?

Who Pays Apple Pay Fees?

Table of Contents

Apple Pay fees are borne by two main parties: credit card issuers and merchants.

- Credit Card Issuers: When a customer uses Apple Pay to make a purchase with their credit card, the credit card issuer is responsible for paying a transaction fee to Apple. This fee is typically set at 0.15% of the transaction amount. Essentially, this means that for every transaction made through Apple Pay, a small percentage of the transaction value is paid by the credit card issuer to Apple.

- Merchants: Merchants also bear a portion of the Apple Pay fees. Specifically, they pay a transaction fee to their payment processor every time a customer uses Apple Pay for a purchase in their store. This fee usually amounts to around 2-3% of the transaction value. However, it’s worth noting that the exact fee may vary depending on the payment processor used by the merchant and the type of credit card employed by the customer.

Here’s a step-by-step breakdown of how the payment process through Apple Pay unfolds, along with who is responsible for paying the associated fees:

- A customer opts to use Apple Pay to make a purchase at a merchant’s establishment.

- The customer’s Apple device initiates communication with the merchant’s payment terminal using near-field communication (NFC) technology.

- The credit card details of the customer are encrypted and then transmitted to the merchant’s payment processor.

- The merchant’s payment processor proceeds to verify the transaction with the credit card issuer of the customer.

- If the transaction is approved, the merchant’s payment processor transfers the payment to the merchant’s bank account.

- Subsequently, the merchant’s bank account remits the payment to the credit card issuer of the customer.

- Finally, it is the responsibility of the credit card issuer to pay Apple the stipulated transaction fee.

It’s crucial to emphasize that Apple does not impose any fees on users for utilizing Apple Pay. Instead, the transaction costs are covered by the banks and merchants participating in the transaction.

In terms of the ultimate payer of Apple Pay fees, it falls upon consumers in the form of potentially higher prices for goods and services.

Merchants who accept Apple Pay might incorporate the expense of transaction fees into their pricing structure. Likewise, credit card issuers may pass on the cost of these fees to their customers through mechanisms like elevated interest rates or annual fees.

However, it is worth noting that Apple Pay also confers benefits to both merchants and consumers.

- For merchants, it can serve as a tool to mitigate fraud and bolster sales.

- For consumers, Apple Pay presents a secure and convenient means of conducting transactions for goods and services.

Also check out: How to Use Apple Pay at ATMs in 2023

How Does Apple make money from Apple Pay?

Apple makes money from Apple Pay with transaction fees and instant transfer fees which are paid by the banks and financial institutions involved in each transaction made using Apple Pay.

It is estimated that Apple generated over $1 billion in revenue from Apple Pay in 2022 and this revenue stream is expected to grow in the coming years as more and more people adopt contactless payment methods.

How Does Apple Pay Work?

Apple Pay is a contactless payment system that enables customers to use their iPhone, iPad, and Apple Watch to make purchases.

The iPhone 6 and newer models’ near field communication (NFC) chip is what allows the service to be provided. Then, the said chip communicates wirelessly with the point-of-sale (POS) terminals utilized by retailers.

All Apple devices already have Apple Pay pre-installed. Users only need to connect their debit, credit, and prepaid cards to Apple’s Wallet app to gain access to it. The user’s default payment card is the first card registered in the Wallet.

Once the card is linked, users can use it to make transactions both online and off. The smartphone model ultimately determines how you can access Apple Pay. For instance, to activate Apple Pay on an iPhone 13, customers must double-tap the Power button on the right.

Apple has also put in place a number of safeguards to protect your personal and financial data. Users may only make payments when they get through Apple’s biometric security measures, such as Touch ID or facial recognition.

Tokenization is a form of encryption that is also used by Apple Pay. Merchants receive a tokenized number instead of your card’s account information, and access to it requires a dynamic security code that changes with each transaction.

Apple has already released more financial goods in addition to its Pay feature. For instance, it introduced an Apple-branded credit card in 2019 in collaboration with Goldman Sachs.

Additionally, it launched a Buy Now, Pay Later (BNPL) option called Apple Pay Later in 2022, enabling customers to pay in a series of installments.

Finally, it should be emphasized that only iOS-compatible smartphones support Apple Pay. As a result, Android users are not permitted to utilize the service.

How Does Apple Pay Make Money – A Detailed Breakdown

Apple Pay generates revenue by charging its card-issuing partners a percentage fee and by levying fees on quick transactions.

Apple receives the vast bulk of its revenue from payments in the form of a 0.15 percent fee that it levies against the card issuer.

Regular credit card processing fees (ranging from 1.15 percent plus $0.05 to 3.15 percent plus $0.10) are also charged on top of that and are accordingly covered by the business accepting the payment.

As was already mentioned, distribution is the key to success here. The more individuals who sign up for Apple Pay and use it, the more money the phone maker will make.

Apple has already taken a range of actions to increase adoption. First and foremost, when older non-NFC devices are replaced with NFC-enabled ones, the introduction of new NFC-enabled devices instantly increases the number of users.

1.8 billion Apple devices are currently in use, most of which were probably acquired when Pay debuted in 2014.

Second, by entering new markets, Apple increases adoption. It frequently does it with the aid of neighborhood banking partners, who encourage their own clientele to use Apple Pay as they make money on the credit card processing fees and are thus incentivized to make it as easy as possible for customers to pay.

Apple, for instance, earlier declared a relationship with the Neobank Revolut. Apple Pay was introduced to 16 additional markets where Revolut operated in 2019 by the challenger bank itself.

Third, Apple and its partners frequently give discounts to entice people to sign up, whether they be banks or merchants. These discounts can range from cash for sign-ups to percentage reductions on purchases.

Educating consumers about the device and how to use it is the hardest problem. Customers are significantly more inclined to give it a try if you provide them with a variety of incentives.

Tim Cook

Additionally, it is quite unlikely that people will return to using a real card or even cash after they become acclimated to using Apple Pay.

The price that Apple levies for instant transfers inside of its Cash program is another, albeit much smaller, revenue stream.

Similar to Venmo, Cash also offers free user-to-user money transfers. Users using iMessage or Wallet can send and receive money using Apple Cash, a virtual card.

Users who want to transfer money from their Apple Cash card can either use Instant Transfers to send the money right away to a Mastercard or Visa debit card partner, or they can get the money from their bank account (which takes 1 to 3 days).

As a result, Apple assesses a 1.5 percent fee to users of Instant Transfer. The minimum and maximum fees are $0.25 and $15 respectively.

An important component of Apple’s platform business model strategy is the introduction of supplementary items that it can later monetize.

The products it sells, most notably the iPhone, are what drive it. These devices then serve as a sort of entry point into other goods that Apple can sell and profit from. Services is the new name for the unit under which Pay is classified.

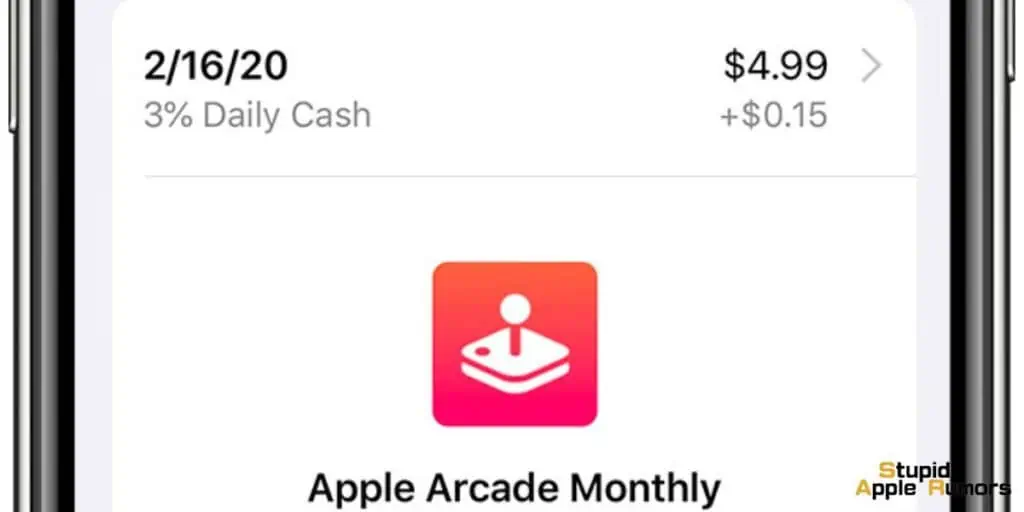

In addition to paying fees, Apple also makes money through services including the App Store (which charges developers a fee), iCloud, the gaming arcade, Music, Apple TV+, and Apple Care.

Apple’s business strategy is thus changing from relying less on the growth of hardware sales to instead extracting more money from active devices. To that purpose, Apple has released a number of software updates that prolong the life of its products.

This transition is especially noticeable when compared to the company’s previous business methods. Apple was fined $113 million in 2020 for limiting performance on outdated devices (a case known as Batterygate).

Surprisingly, that ecosystem concept has been extended to the company’s payments sector as well. Apple’s payment services include not only Pay and Cash but also Pay Later (BNPL) and Tap to Pay (turning the iPhone or iPad into a payment terminal).

To increase adoption, Pay Later and Tap to Pay are not yet commercialized. However, once such becomes commonplace, Apple is sure to turn on the dial (i.e., customers are accustomed to using the product, leading to additional business for merchants).

Apple, for example, could charge merchant fees and interest on its BNPL product. After all, big BNPL firms like Affirm derive the majority of their revenue in this manner.

Apple might also charge merchants for its payment terminal. For comparison, Square’s typical processing cost is 2.6 percent plus $0.10.

The single most significant benefit for merchants is that they would not need to purchase an expensive terminal and could instead utilize an Apple device that they already own.

Apple’s payment and other divisions continue to be plagued by anti-competitive activities. However, it cannot be denied that payment fees have become an important element of the firm’s revenue mix, which is why both analysts and customers continue to be bullish on the company.

How much money does Apple make when I use Apple Pay?

- A small portion of the transaction charge, I believe a portion of the portion that banks ordinarily give to the marketing affiliate (i.e., the portion that Disney receives for a Disney Mastercard or the one that Unite receives for a United Visa), is chopped off and sent to Apple. This is money that the ApplePay customer does not directly pay; it is money that the retailer already pays to process the card.

- In theory, ApplePay increases the value of iPhones, iPads, Apple Watches, and Apple’s laptops and desktops, therefore ApplePay accounts for a small portion of those goods’ profits.

Apple is more concerned with the second method but does nothing to track it. They do, however, keep track of the first way.

The second way is also how the majority of Apple’s features generate revenue, however, a few (such as Apple Music and the App Store) generate revenue more directly.

How does Apple make money from Apple Pay – Conclusion

Apple Pay is easy, quick, and convenient to use making it the most popular online payment system. For Apple, this is important as they make a lot of money directly from Apple Pay.

How? By charging card issuers for each transaction. Since Apple only charges card issuers, the customers don’t take a hit and so they make more payments.

We hope this guide on How does Apple make money from Apple Pay answers all your questions.

Also Read: